The “Iron Condor” is a sophisticated options trading strategy designed to profit from a stock trading within a specific, limited price range. It’s a neutral strategy, meaning it doesn’t bet on a significant upward or downward movement of the underlying asset. Instead, it thrives on low volatility, aiming to collect premium from selling options that expire out-of-the-money. This makes it an attractive strategy for traders who anticipate a period of stability in a particular stock or index.

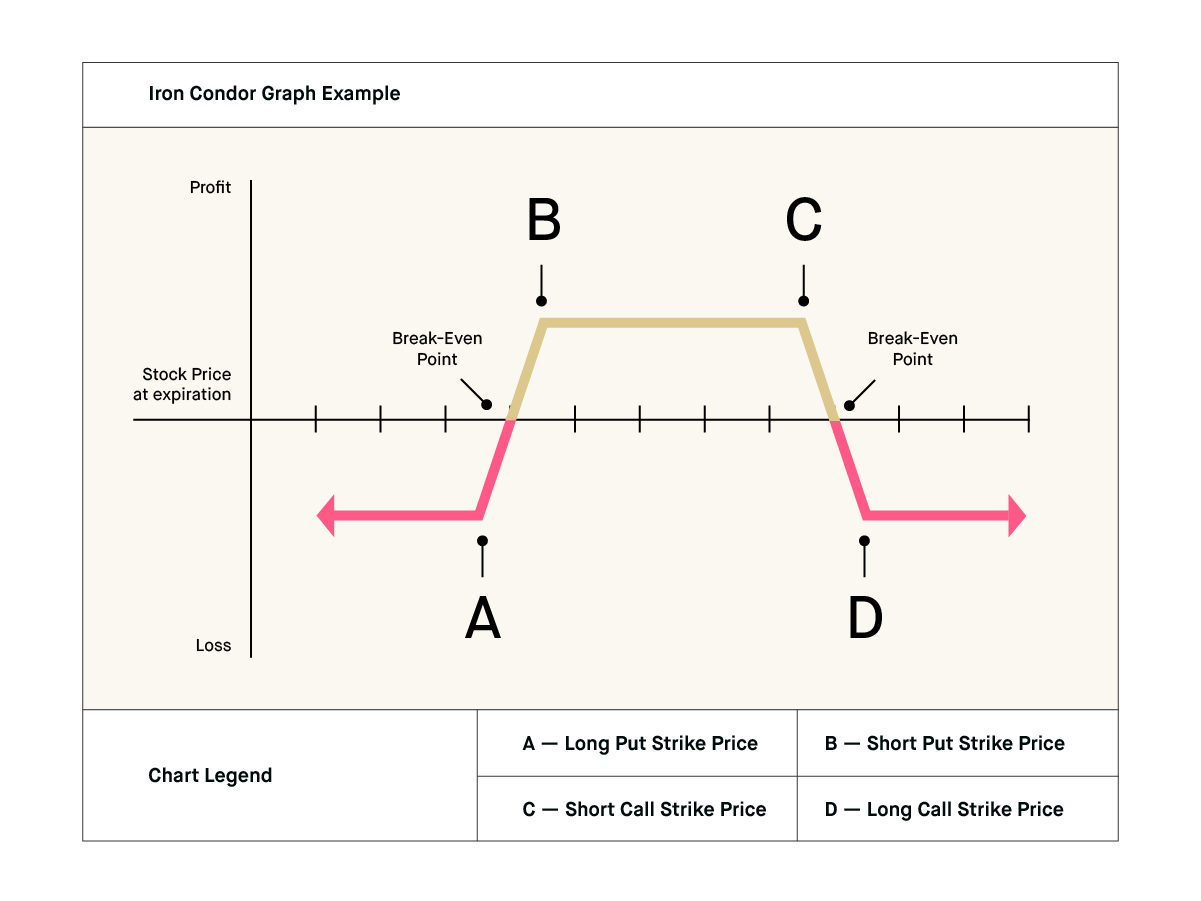

The construction of an iron condor involves four distinct option legs, each representing a different strike price. These legs consist of two put options and two call options, all with the same expiration date. The core principle is to sell both an out-of-the-money (OTM) call and an OTM put, while simultaneously buying further OTM call and put options as protection. This creates a defined risk and reward scenario, offering a clear profit potential and a capped maximum loss.

Understanding the mechanics of an iron condor requires a solid grasp of options terminology and trading principles. It’s a strategy that, while offering a defined outcome, demands careful monitoring and management to ensure profitability.

Deconstructing the Iron Condor Strategy

At its heart, the iron condor is a combination of two credit spreads: a bear call spread and a bull put spread. This layered approach is what defines its neutral stance and its profit-generating mechanism.

The Anatomy of the Trade

To execute an iron condor, a trader will perform the following four transactions simultaneously:

- Sell one Out-of-the-Money (OTM) Call: This is the highest strike price of the four options. The expectation is that the underlying asset’s price will remain below this strike price by expiration.

- Buy one Further Out-of-the-Money (OTM) Call: This strike price is higher than the OTM call sold. This leg acts as a protective measure, capping the potential loss on the call side of the strategy. The premium paid for this option is less than the premium received for the sold call.

- Sell one Out-of-the-Money (OTM) Put: This is the lowest strike price of the four options. The expectation is that the underlying asset’s price will remain above this strike price by expiration.

- Buy one Further Out-of-the-Money (OTM) Put: This strike price is lower than the OTM put sold. Similar to the long call, this leg serves as protection for the put side, limiting potential losses. The premium paid for this option is less than the premium received for the sold put.

The net result of these transactions is a net credit received. This credit represents the maximum potential profit of the iron condor strategy. The difference between the strike prices of the sold and bought options (both for calls and puts) dictates the width of the “wings” of the iron condor and, consequently, the maximum potential loss.

The Credit Received and Initial Setup

The initial credit received from selling the OTM call and OTM put is the primary source of profit for an iron condor. This credit is the difference between the premiums collected from the sold options and the premiums paid for the bought options. The goal is for both of the sold options to expire worthless, allowing the trader to keep the entire net credit.

The selection of strike prices is crucial. Typically, traders will choose strikes that are equidistant from the current price of the underlying asset. This creates a symmetrical profit zone. The width of the spread between the sold and bought options is also a key consideration. Wider spreads offer higher potential profits and larger maximum losses, while narrower spreads present lower profit potential and reduced maximum risk. The proximity of the sold strikes to the current market price will influence the probability of the trade being profitable.

Profit and Loss Scenarios

The iron condor strategy has defined maximum profit and maximum loss, making it a predictable trade in terms of risk. The profit zone is determined by the strike prices of the short options.

Maximum Profit Potential

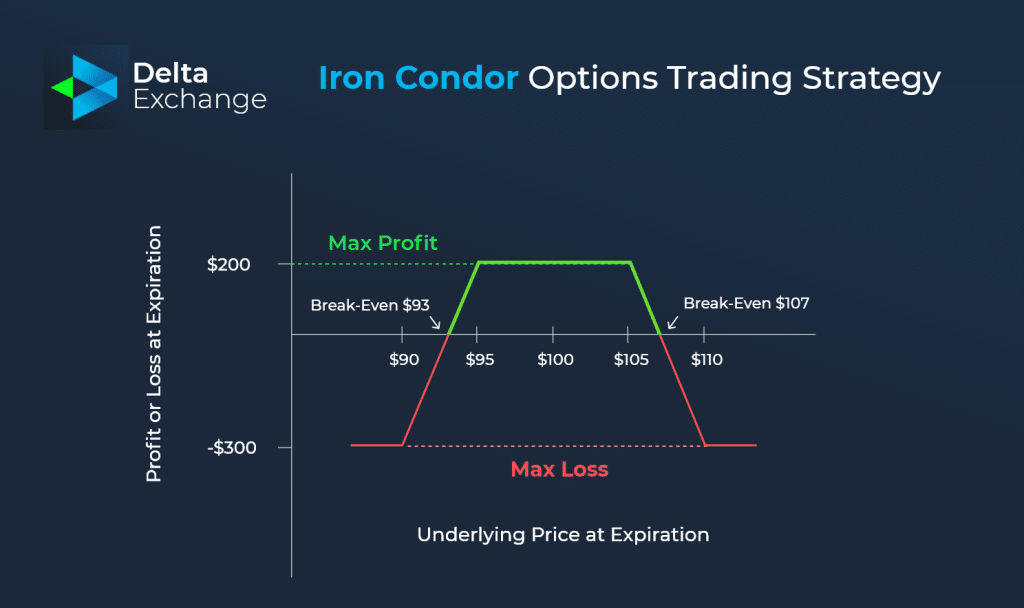

The maximum profit for an iron condor is realized if the underlying asset’s price at expiration is between the strike prices of the two short options (the short put and the short call). In this scenario, both the short put and the short call expire worthless. The trader keeps the entire net credit received when initiating the trade.

Mathematically, Maximum Profit = Net Credit Received.

This scenario represents the ideal outcome for an iron condor trader, where the market has remained range-bound as anticipated.

Maximum Loss Scenario

The maximum loss occurs if the underlying asset’s price moves significantly beyond either of the short strike prices, and the protective long options do not sufficiently offset the losses from the short options.

- On the Call Side: If the price of the underlying asset closes above the strike price of the long call, the trader incurs a loss. The loss is capped at the difference between the strike prices of the long and short calls, minus the net credit received.

- Maximum Loss (Call Side) = (Strike Price of Long Call – Strike Price of Short Call) – Net Credit Received.

- On the Put Side: Similarly, if the price of the underlying asset closes below the strike price of the long put, the trader incurs a loss. The loss is capped at the difference between the strike prices of the short and long puts, minus the net credit received.

- Maximum Loss (Put Side) = (Strike Price of Short Put – Strike Price of Long Put) – Net Credit Received.

The overall maximum loss for the iron condor is the larger of these two potential losses, as the strategy is designed to protect against extreme moves on either side. The width of the “wings” (the distance between the short and long strikes on each side) directly determines the maximum potential loss.

Break-Even Points

There are two break-even points for an iron condor, marking the levels at which the trade neither profits nor loses money.

- Upper Break-Even Point: This is calculated by adding the net credit received to the strike price of the short call. If the underlying asset’s price is at or above this level at expiration, the trade will result in a loss.

- Upper Break-Even = Strike Price of Short Call + Net Credit Received.

- Lower Break-Even Point: This is calculated by subtracting the net credit received from the strike price of the short put. If the underlying asset’s price is at or below this level at expiration, the trade will result in a loss.

- Lower Break-Even = Strike Price of Short Put – Net Credit Received.

The profit zone lies between these two break-even points.

When to Employ an Iron Condor Strategy

The iron condor is best suited for specific market conditions and trader objectives. Its neutral bias makes it a strategic choice when other directional bets are not favored.

Anticipating Low Volatility and Range-Bound Markets

The ideal environment for an iron condor is one where the underlying asset is expected to trade within a relatively narrow range. This often occurs in periods of low implied volatility or when a stock is consolidating after a significant price move. Traders often employ iron condors before events that are unlikely to cause a dramatic market reaction, such as before economic data releases that are expected to be in line with forecasts or before earnings reports where the company has a history of stable performance.

The strategy benefits from the passage of time (theta decay), as options lose value as they approach their expiration date. When the underlying price remains stagnant, this decay works in favor of the option seller. Conversely, a sharp move in either direction can quickly lead to losses.

Managing Risk and Defining Potential Outcomes

One of the most significant advantages of the iron condor is its defined risk profile. Before entering the trade, a trader knows the maximum amount they can lose and the maximum amount they can profit. This predictability allows for better risk management and portfolio allocation.

For traders who have a strong conviction that a particular stock will not experience significant price fluctuations, the iron condor offers a way to monetize that expectation. It’s a strategy that can be applied to a variety of underlying assets, including individual stocks, exchange-traded funds (ETFs), and even stock indices.

Considerations for Implementation

While the iron condor offers a defined risk and reward, it’s not without its challenges.

- Commissions: With four legs to the trade, commissions can add up, especially for smaller account sizes. Traders need to factor in commission costs when calculating potential profitability.

- Assignment Risk: If an option is in-the-money at expiration, there’s a risk of early assignment, particularly for American-style options. This can force a trader to close out a position prematurely.

- Margin Requirements: While the maximum loss is defined, iron condors often require margin to be held by the brokerage firm, which can tie up capital.

- Management: While the strategy is designed for limited movement, active management is often necessary. Traders may choose to roll positions (close the current options and open new ones with later expiration dates or different strike prices) to manage risk or extend the profit window if the underlying asset begins to move unfavorably.

Adjusting and Managing Iron Condors

The iron condor is not a “set it and forget it” strategy. Active management can significantly improve its success rate and profitability. Adjustments are typically made to mitigate losses or enhance potential gains as market conditions evolve.

Rolling Positions for Profit and Protection

One of the most common adjustments is “rolling” the options. This involves closing out the existing legs of the iron condor and opening a new one with different strike prices or expiration dates.

- Rolling Out in Time: If the underlying asset is moving towards one of the short strikes but hasn’t breached it, a trader might roll the entire iron condor out to a later expiration date. This gives the trade more time to expire worthless and can potentially collect additional premium. This also shifts the profit zone and break-even points further out.

- Rolling Up/Down the Strikes: If the underlying asset is trending towards a short strike, a trader might adjust by rolling the short option further out-of-the-money. Simultaneously, they would likely adjust the corresponding long option to maintain the desired width of the spread. For example, if the price is rising towards the short call, a trader might buy back the short call at a loss and sell a new call at a higher strike, while also adjusting the long call. This is often done to bring in additional credit or to give the underlying more room to move.

These adjustments can help convert a losing trade into a winner or protect existing profits. However, they also incur additional transaction costs and can alter the risk profile of the trade.

Managing an Unfavorable Move

If the underlying asset makes a significant move that challenges the profit zone, traders have several options to manage the risk:

- Accept the Loss: If the loss is within the predefined maximum loss, a trader might simply let the trade expire and accept the loss.

- Convert to a Different Strategy: In some cases, an iron condor that is losing money on one side might be converted into a different strategy. For example, if the price is moving sharply upwards, the put spread might be closed, leaving a bear call spread.

- Close the Trade Early: To limit losses, a trader can choose to close out the entire iron condor position before expiration, even if it results in a loss. This is a disciplined approach to prevent further downside.

The decision to adjust or manage an iron condor depends heavily on the trader’s risk tolerance, market outlook, and the specific parameters of the trade. A well-managed iron condor can be a valuable tool in a diversified options trading portfolio, offering consistent income generation in stable market environments.