The landscape of technological advancement is a dynamic canvas, constantly repainting industries, creating new paradigms, and generating immense wealth for those with the foresight and courage to invest strategically. In this swirling vortex of innovation, the drone industry stands out as a particularly vibrant and rapidly expanding frontier. From hobbyist toys to indispensable tools for commerce, defense, and research, drones represent a convergence of various cutting-edge technologies.

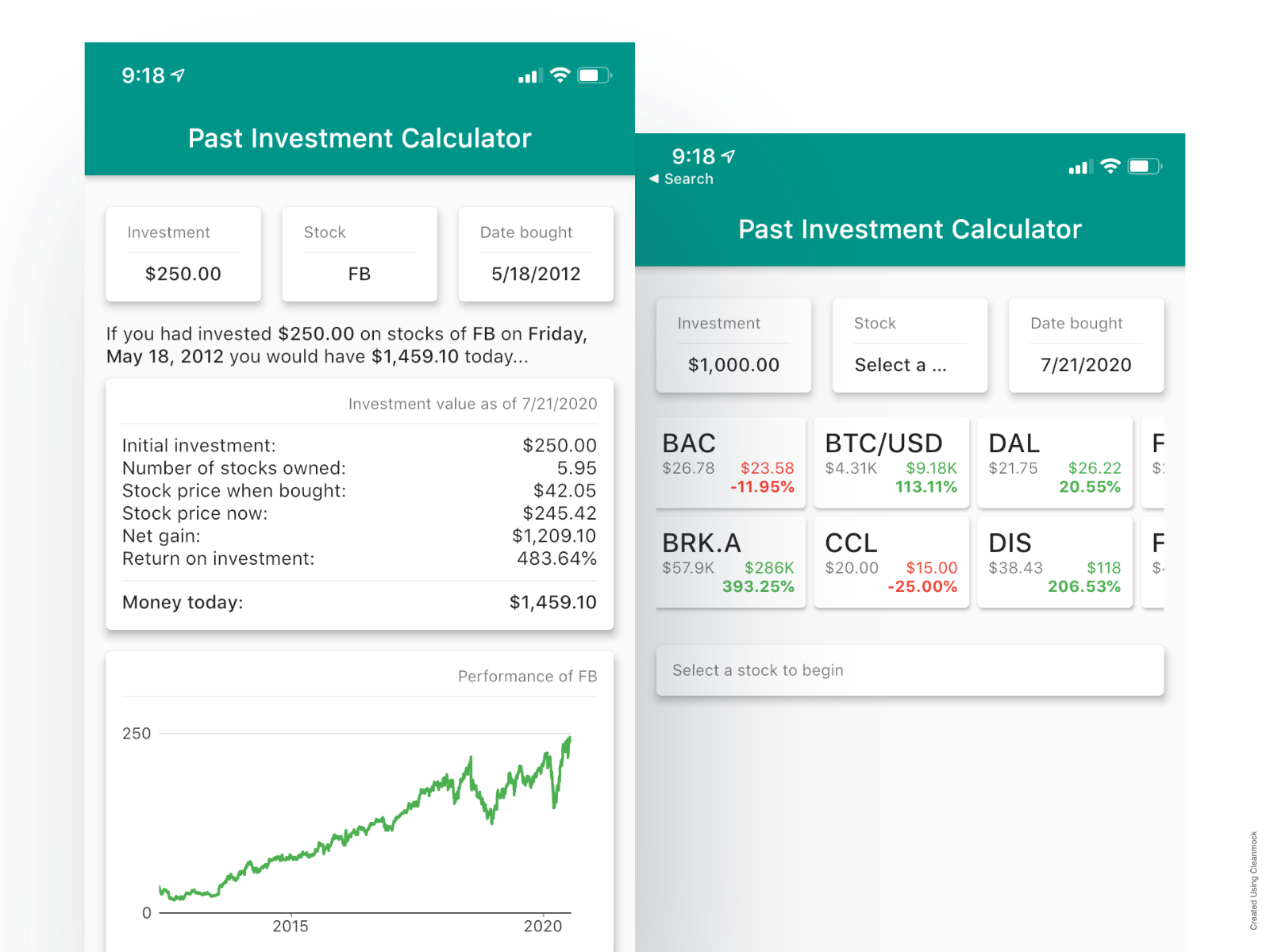

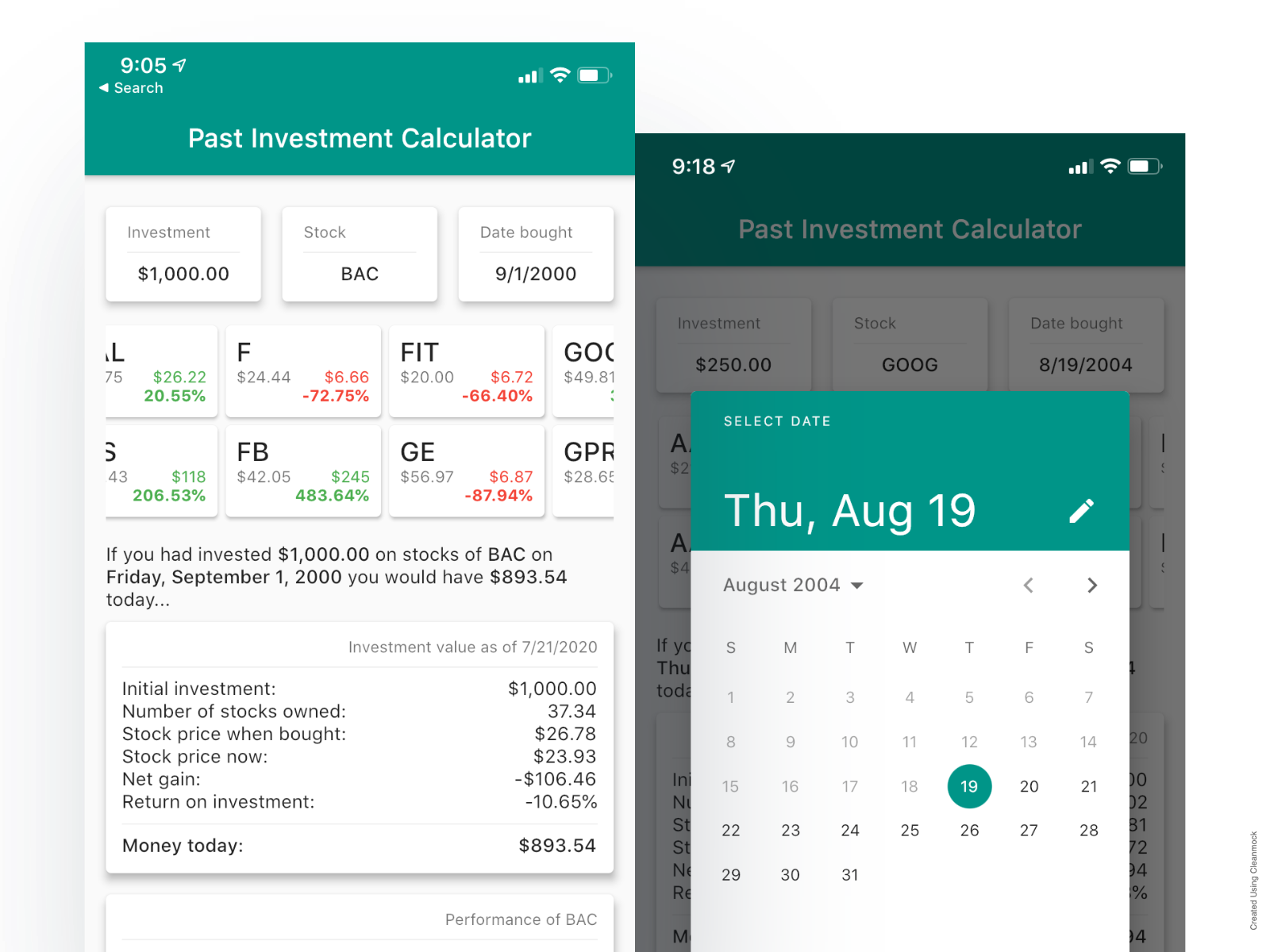

The hypothetical question, “What if I had invested?” often carries a pang of regret for missed opportunities. But what if we reframe this query? What if we consider a sophisticated “stock calculator” not as a financial instrument itself, but as a conceptual tool – an advanced analytical framework designed to identify and quantify the potential returns from investing in nascent, disruptive technologies? Specifically, let’s apply this idea to the drone tech and innovation sector. By examining the past, dissecting the present, and projecting into the future with such a “calculator,” we can uncover profound insights into the mechanics of high-growth tech investment and perhaps inform tomorrow’s strategic decisions.

The Drone Revolution: A Landscape Ripe for Innovation Investment

The evolution of unmanned aerial vehicles (UAVs) has been nothing short of spectacular. What began with military applications quickly proliferated into consumer markets, only to pivot once more towards industrial and enterprise solutions. This exponential growth trajectory makes drone technology a prime candidate for “what if” investment analysis.

Beyond Hobby: The Professional & Industrial Shift

The initial wave of drone popularity was driven by aerial photography and videography enthusiasts. However, the true investment potential emerged as drones transitioned from recreational gadgets to critical professional tools. Today, drones are integral to a multitude of sectors:

- Agriculture: Precision farming, crop monitoring, irrigation management.

- Construction: Site surveying, progress monitoring, safety inspections.

- Infrastructure Inspection: Power lines, pipelines, bridges, wind turbines, cellular towers.

- Logistics & Delivery: Package delivery, medical supply transport, inventory management.

- Public Safety: Search and rescue, law enforcement surveillance, disaster response.

- Environmental Monitoring: Wildlife conservation, pollution detection, climate research.

Each of these applications demands increasingly sophisticated technology, creating fertile ground for innovation and, consequently, for investors seeking high returns. A “stock calculator” focused on tech would have flagged this fundamental shift early, identifying companies that were pivoting from consumer markets to enterprise solutions.

Key Growth Vectors in Drone Tech

To effectively apply our hypothetical “stock calculator,” we must understand the core technological advancements driving the drone industry. These are the areas where investment yields the most significant disruptive potential:

- AI & Autonomous Flight: The ability of drones to operate independently, navigate complex environments, perform tasks without human intervention, and make real-time decisions. This includes advanced machine vision, deep learning for object recognition, and sophisticated path planning algorithms.

- Advanced Sensors & Payload Integration: Miniaturized, high-resolution cameras (4K, thermal, multispectral), LiDAR systems, gas sensors, and communication relays that enhance data collection capabilities for specific industrial needs.

- Battery Technology & Propulsion Systems: Innovations in power density, charging speed, and alternative energy sources (e.g., hydrogen fuel cells) to extend flight times and operational efficiency.

- Connectivity & Data Management: Secure and robust communication links (5G, satellite) for beyond visual line of sight (BVLOS) operations, and cloud-based platforms for processing, storing, and analyzing vast amounts of aerial data.

- Regulatory Framework & UTM (UAS Traffic Management): Software and hardware solutions that enable safe integration of drones into national airspace, crucial for scalable commercial operations.

A shrewd “stock calculator” would identify companies making breakthroughs in these fundamental areas, understanding that these innovations form the bedrock of future drone applications and market dominance.

Unpacking the “Stock Calculator” for Tech Investment Foresight

Our conceptual “stock calculator” for tech innovation isn’t about traditional financial ratios alone. It’s an interdisciplinary analytical engine, combining technical foresight with market acumen.

Algorithmic Prediction & Market Analysis

Imagine a system that ingests vast datasets beyond quarterly earnings:

- Patent Filings & R&D Spend: Tracking intellectual property development and investment in research across the drone ecosystem. Companies with a strong patent portfolio in core drone technologies often signal future market leadership.

- Scientific Publications & Research Grants: Identifying academic and institutional breakthroughs that could be commercialized.

- Talent Acquisition & Employee Growth: Monitoring the hiring patterns of skilled engineers, AI specialists, and roboticists, indicating where innovation capital is flowing.

- Competitive Landscape Mapping: Analyzing market share, product differentiation, strategic partnerships, and acquisitions within specific drone tech niches (e.g., drone delivery platforms vs. industrial inspection software).

- Regulatory Scans: Predicting the impact of evolving aviation regulations on drone operations and market entry for specific technologies.

This “calculator” wouldn’t just tell you what companies exist; it would predict which companies are best positioned for disruptive growth based on their foundational innovation.

Quantifying Intangibles: IP, Talent, and Disruption Potential

One of the greatest challenges in valuing tech startups, especially in rapidly evolving fields like drones, is quantifying intangible assets. A traditional “stock calculator” struggles here. Our tech-focused variant would attempt to:

- Value Intellectual Property (IP): Beyond just the number of patents, it would assess the quality, breadth, and strategic importance of a company’s IP in critical tech areas (e.g., autonomous navigation algorithms, specialized sensor fusion).

- Assess Human Capital: Evaluate the leadership team’s experience, the engineering team’s depth, and the company’s ability to attract and retain top talent – a crucial indicator of future innovation.

- Model Disruption Potential: Analyze a technology’s capacity to fundamentally alter existing industries or create entirely new markets. For instance, early AI-powered obstacle avoidance systems had immense disruption potential for urban drone operations.

- Project Ecosystem Influence: How well a company’s technology integrates with broader platforms or fosters a developer ecosystem, thereby amplifying its reach and value.

The “what if” scenario here becomes even more potent: what if we had a system capable of accurately predicting the long-term impact of these intangibles years before they translated into significant revenue?

Case Studies: Missed Opportunities and Future Prospects in Drone Tech

To illustrate the power of our hypothetical “stock calculator,” let’s consider some “what if” moments in drone tech history and project towards future possibilities.

Early-Stage Drone Hardware Innovators

Imagine a “stock calculator” in the early 2010s. It would have flagged companies like DJI, not just for their consumer camera drones, but for their foundational investments in flight control systems, brushless motors, and miniaturized gimbals. While not publicly traded for direct stock investment, the principle applies: recognizing the underlying hardware prowess that would underpin an entire industry. What if investors had poured capital into their early development or analogous companies? The exponential growth of the drone market would have yielded staggering returns. Our calculator would have identified the scalability and versatility of their core technology.

Software & AI for Autonomous Flight

The real revolution in drones is often in their “brains.” Companies developing sophisticated AI for navigation, object recognition, and autonomous mission planning are goldmines. Think about the “what if” of investing in the companies that built the software for AI follow mode, precise mapping algorithms, or self-landing capabilities. These aren’t just features; they’re foundational technologies that enable a host of commercial applications, from automated delivery to hands-free inspection. A “stock calculator” would scrutinize the robustness of their algorithms, their data processing capabilities, and their ability to secure certifications for complex flight operations.

Data & Mapping Solutions

Drones are extraordinary data collection platforms. The true value, however, often lies in the companies that can process, analyze, and present this data in actionable ways. What if we had invested early in companies specializing in photogrammetry software, 3D modeling from drone imagery, or cloud platforms for managing vast aerial datasets? The “stock calculator” would have identified the high margins and scalability of software-as-a-service (SaaS) models built around drone data, realizing that the data itself, and the insights derived from it, are often more valuable than the drone hardware.

Building Your Own “What If” Investment Strategy in Tech Innovation

While our “stock calculator” remains largely conceptual, the principles it embodies are actionable. You can apply a similar rigorous, forward-looking analysis to your own tech investment strategy.

Researching Emerging Drone Technologies

- Follow Industry News & Tech Journals: Stay abreast of breakthroughs in AI, robotics, sensor technology, and aerospace.

- Attend Tech Conferences: Engage with innovators, observe product demonstrations, and gauge industry sentiment.

- Monitor Patent Databases: Identify companies filing patents in key drone tech areas.

- Analyze VC Funding Rounds: Where are venture capitalists deploying capital in the drone ecosystem? This often indicates promising startups.

Diversification and Risk Mitigation in High-Growth Sectors

Investing in tech innovation carries inherent risks. Many startups fail. Therefore:

- Diversify Across Sub-sectors: Don’t put all your eggs in one basket (e.g., invest in hardware, software, and service providers).

- Consider ETFs/Funds: For broader exposure to drone tech or robotics without picking individual stocks.

- Start Small: Allocate a prudent portion of your portfolio to these high-risk, high-reward opportunities.

The Long Game: Patience for Exponential Returns

Tech innovation investments are rarely short-term plays. Disruptive technologies often take years to mature, gain widespread adoption, and generate significant returns. The “what if” scenarios often look back over a decade or more. Patience, combined with continuous monitoring of technological progress and market shifts, is paramount.

Conclusion

The question “what if I had invested” is more than just a nostalgic lament; it’s a powerful thought experiment. By conceptualizing an advanced “stock calculator” for tech innovation, especially within the dynamic drone sector, we can deconstruct the elements that lead to exponential growth. It highlights the importance of understanding underlying technological trends, evaluating intangible assets, and adopting a long-term, strategic investment mindset. While no actual calculator can perfectly predict the future, adopting its analytical rigor allows us to transform the “what if” from a moment of regret into a potent framework for identifying and capitalizing on the next wave of disruptive tech innovation.