The financial landscape is a complex web of transactions, and understanding the terminology used is crucial for smooth operations. One such term that frequently appears in business dealings is “remit payment.” While it might sound straightforward, grasping its full implications, especially within the context of specific industries, can prevent misunderstandings and ensure compliance. This article will delve into the meaning of remitting payment, exploring its nuances and practical applications within the realm of drone technology.

Understanding the Core Concept of Remitting Payment

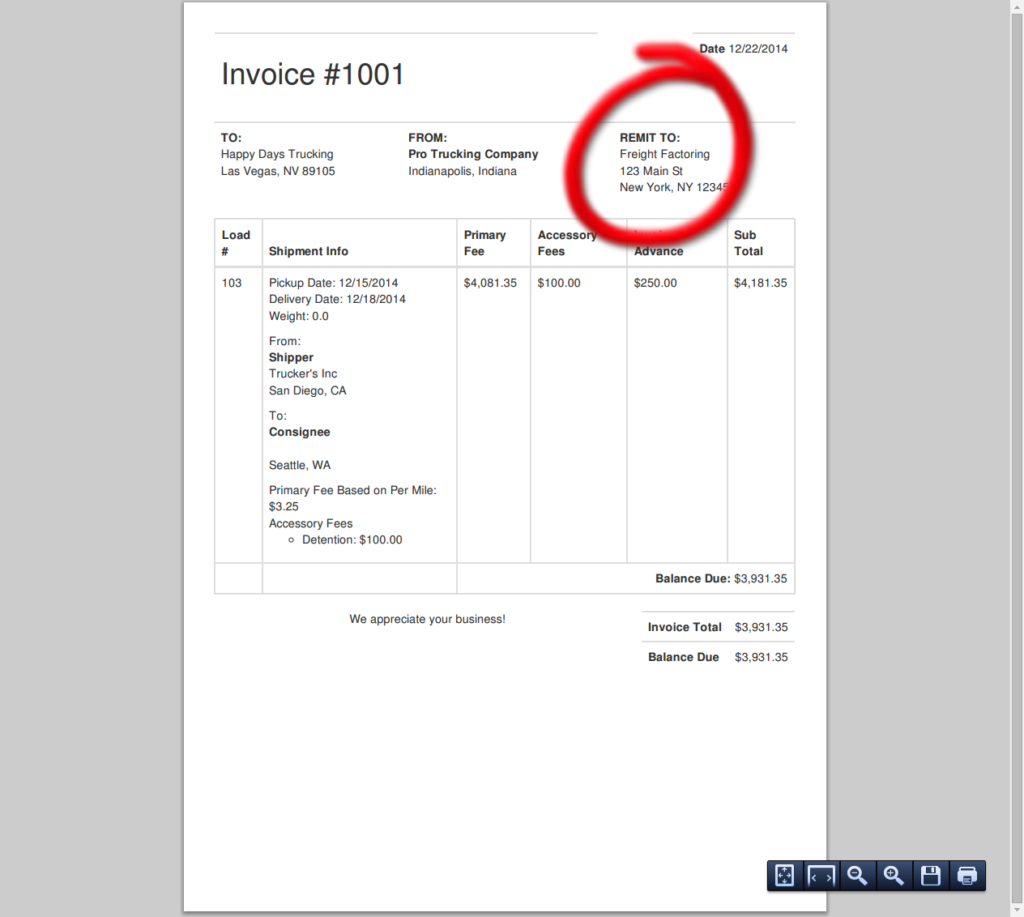

At its most fundamental level, “remitting payment” means to send or transmit money in settlement of a debt or obligation. It is the act of forwarding funds from one party to another to fulfill a financial commitment. This can encompass a wide range of transactions, from paying an invoice for goods or services to fulfilling contractual obligations. The key element is the transfer of funds to discharge a liability.

The Mechanics of Remitting Payment

The act of remitting payment is not a monolithic process; it can be executed through various methods, each with its own advantages and considerations. These methods are often dictated by the nature of the transaction, the preferences of the parties involved, and regulatory requirements.

Traditional Payment Methods

Historically, remitting payment often involved physical methods. This includes sending a check via mail, which involves the issuer writing a check and the payee depositing or cashing it. While still in use, this method is generally slower and carries a higher risk of loss or delay compared to modern alternatives. Another traditional method is a wire transfer, a more immediate but often more costly option for transmitting funds between banks. These methods, while familiar, are increasingly being supplanted by more efficient digital solutions.

Digital and Electronic Payment Channels

The advent of digital technologies has revolutionized how payments are remitted. Electronic Funds Transfer (EFT) encompasses a broad spectrum of digital payment methods, including direct deposits, automated clearing house (ACH) transactions, and various online payment platforms. These methods are generally faster, more secure, and offer greater traceability than traditional means. For businesses, particularly those operating in fast-paced sectors like drone technology, utilizing efficient digital remittance channels is paramount for maintaining cash flow and operational agility.

The Importance of Timeliness and Accuracy

Regardless of the method employed, the timeliness and accuracy of remitted payments are critical. Late payments can incur penalties, damage creditworthiness, and strain business relationships. Similarly, inaccurate payments, whether due to errors in the amount or incorrect recipient details, can lead to further complications, reconciliation issues, and potential legal disputes. Therefore, a clear understanding of the payment terms and diligent execution of the remittance process are essential.

Remitting Payment in the Drone Technology Sector

The drone industry, with its rapid advancements and diverse applications, presents unique scenarios where remitting payment plays a vital role. From the purchase of complex aerial hardware to the settlement of fees for specialized drone services, the financial aspects are as integral as the technological ones.

Acquiring Drone Hardware and Software

The initial investment in drone technology often involves significant capital outlay. Purchasing a professional-grade drone, its accompanying accessories, and specialized software licenses requires a structured approach to payment. Suppliers and manufacturers expect timely remittance for their products. This could involve upfront payments, installment plans, or pre-orders, all of which necessitate clear communication and adherence to payment schedules. For businesses operating on tight budgets, understanding the payment terms associated with drone acquisitions can be a deciding factor in their procurement strategy.

Supplier and Manufacturer Agreements

When procuring drones, components, or proprietary software, businesses enter into agreements with suppliers and manufacturers. These agreements meticulously outline the payment terms, including the amount due, the currency, the accepted payment methods, and the due date for remittance. Failure to adhere to these terms can lead to delayed delivery, cancellation of orders, or even legal action. Therefore, a thorough review of these agreements and a robust internal process for managing payments to suppliers are crucial.

Software Licensing and Subscriptions

Beyond the hardware, the drone ecosystem relies heavily on sophisticated software for flight control, data analysis, mapping, and image processing. Many of these software solutions are offered through licensing or subscription models. Remitting payments for these ongoing services ensures continuous access to critical functionalities and updates. The regularity of these payments, often monthly or annually, requires a reliable system to prevent service interruptions and maintain operational continuity.

Settling Fees for Drone Services and Operations

The application of drone technology extends far beyond mere hardware acquisition. Businesses frequently engage specialized drone service providers for a variety of tasks, such as aerial surveying, infrastructure inspection, agricultural monitoring, and cinematic videography. These services, when rendered, generate invoices that require remittance. The nature of these services often involves complex project scopes, and the payment terms are typically negotiated upfront.

Project-Based Invoicing and Payment Milestones

For larger drone projects, payment is often structured around milestones. This means that portions of the total payment are remitted upon the successful completion of specific project phases. For instance, a mapping project might require an initial deposit, a mid-project payment, and a final remittance upon delivery of the processed data. This phased approach helps both the client and the service provider manage financial risks and ensures that payments are aligned with tangible progress. Clear communication regarding these milestones and the associated payment triggers is essential.

Recurring Service Agreements and Retainers

In cases of ongoing drone operations or continuous data collection, service providers might establish recurring service agreements or retainer-based contracts. This could involve a monthly fee for regular aerial inspections of a construction site or an annual retainer for emergency response drone support. Remitting these regular payments ensures uninterrupted service and a predictable cost structure for the client. Automated payment systems are often employed to facilitate these recurring remittances, reducing administrative burden and minimizing the risk of missed payments.

Ensuring Compliance and Best Practices in Payment Remittance

Navigating the financial intricacies of remitting payments in any industry requires a commitment to compliance and the adoption of best practices. This is particularly true in technology-driven sectors where regulations, security, and efficiency are paramount.

Understanding Payment Terms and Agreements

The cornerstone of proper payment remittance lies in a clear and comprehensive understanding of the underlying payment terms. This involves scrutinizing contracts, invoices, and any other documentation that outlines financial obligations. Key aspects to clarify include the total amount due, the currency of the transaction, the due date for remittance, any applicable taxes or fees, and the specific payment methods accepted. Proactive communication with the paying party to resolve any ambiguities before the due date is a sign of professionalism and helps prevent disputes.

Invoice Review and Verification

Before any payment is remitted, a thorough review and verification of the invoice are essential. This involves checking that the services or goods listed on the invoice correspond to what was agreed upon, that the quantities and prices are accurate, and that there are no unauthorized charges. For drone-related services, this might include verifying flight logs, data deliverables, or the successful completion of agreed-upon tasks. Discrepancies should be immediately flagged and addressed with the invoicing party.

Contractual Obligations and Payment Schedules

Beyond individual invoices, understanding the broader contractual obligations is vital. Many commercial agreements, especially in the drone sector, stipulate detailed payment schedules, including down payments, milestone payments, and final payments. Adhering to these schedules is not just a matter of financial good practice but also a legal requirement. Failure to comply can lead to breaches of contract, with potential consequences ranging from late fees and interest charges to contract termination and legal liabilities.

Leveraging Technology for Efficient Remittance

The digital age offers a powerful toolkit for streamlining and securing the payment remittance process. Businesses in the drone industry can leverage these technologies to enhance efficiency, reduce errors, and improve overall financial management.

Online Payment Portals and Gateways

Many businesses now offer online payment portals or integrate with payment gateways, allowing for direct, electronic remittance. These platforms often support various payment methods, including credit cards, debit cards, and ACH transfers, providing flexibility for payers. They also offer features like automated payment reminders, transaction tracking, and secure data handling, which contribute to a more robust and user-friendly remittance experience.

Accounting Software and Automated Workflows

Integrating payment remittance with robust accounting software can significantly enhance efficiency. Such software can automate invoice generation, track outstanding payments, schedule reminders, and facilitate direct electronic transfers. By creating automated workflows, businesses can reduce manual data entry, minimize the risk of human error, and ensure that payments are processed promptly and accurately. This is particularly beneficial for managing numerous transactions, as is often the case in growing drone enterprises.

Secure Data Handling and Fraud Prevention

In an era of increasing cyber threats, ensuring the security of payment information is paramount. When remitting payments electronically, it is crucial to use platforms that employ strong encryption protocols and adhere to industry-standard security measures. Businesses should also implement internal policies and procedures to protect sensitive financial data and guard against fraud. This includes educating staff on cybersecurity best practices and regularly reviewing security protocols.

Conclusion: The Integral Role of Remitting Payment in Drone Operations

In essence, “remitting payment” is the act of fulfilling financial obligations, a fundamental pillar of any commercial or operational activity. Within the dynamic and rapidly evolving drone technology sector, understanding and executing this process effectively is not merely a transactional necessity but a strategic imperative. From the initial acquisition of cutting-edge drone hardware and software to the ongoing settlement of fees for specialized aerial services, timely and accurate remittance ensures the smooth functioning of operations, fosters strong business relationships, and underpins the financial health of enterprises. By embracing clear communication, meticulous attention to contractual terms, and the judicious application of modern payment technologies, businesses in the drone industry can navigate the complexities of financial transactions with confidence, paving the way for innovation and growth.