The world of finance can often feel like a labyrinth, especially when you’re looking to secure a loan. Whether it’s for a significant personal investment, expanding a business, or even acquiring a high-value technological asset, understanding the prerequisites for loan approval is paramount. This article will demystify the process, guiding you through the essential steps and considerations that lenders will scrutinize. From demonstrating financial responsibility to presenting a compelling case for repayment, we’ll break down what you need to do to increase your chances of securing that coveted loan.

Understanding the Lender’s Perspective

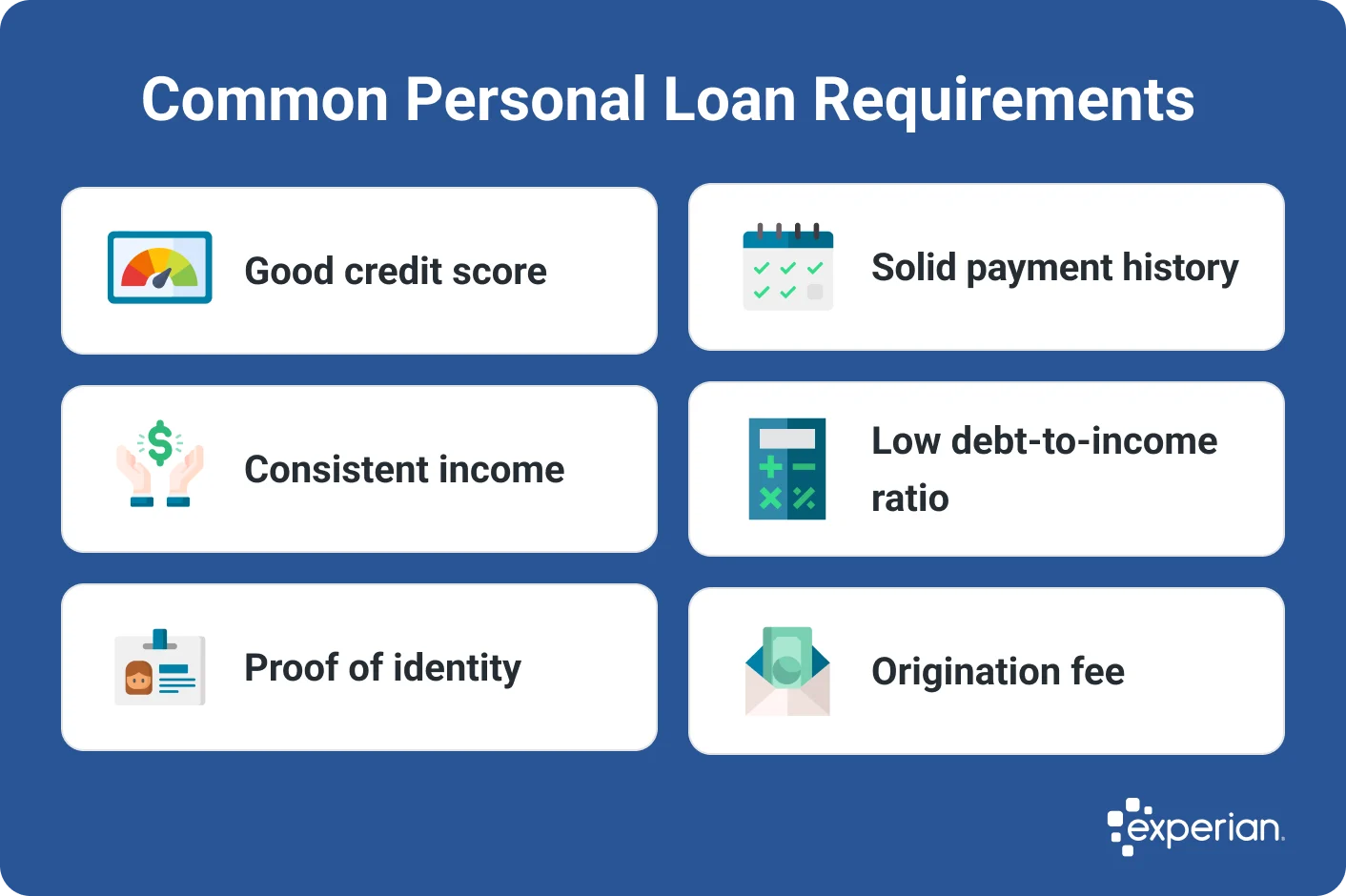

Before you even begin to fill out an application, it’s crucial to step into the shoes of the lender. Their primary concern is mitigating risk. They need to be confident that you have the capacity and the intention to repay the borrowed funds, along with any accrued interest, within the agreed-upon timeframe. This confidence is built upon a thorough assessment of your financial health, your proposed use of the funds, and your overall creditworthiness. Lenders evaluate potential borrowers through several key lenses, and understanding these will significantly improve your loan application strategy.

Assessing Your Financial Health: The Foundation of Trust

Your financial health is the bedrock upon which any loan application is built. Lenders will meticulously examine your financial history to gauge your reliability and your ability to manage debt. This assessment goes beyond a simple snapshot; it’s a comprehensive review of your past financial behavior and your current financial standing.

Credit Score: Your Financial Report Card

Your credit score is arguably the most significant factor lenders consider. It’s a numerical representation of your creditworthiness, compiled from your credit history. A higher credit score indicates a lower risk to the lender, suggesting you have a proven track record of managing credit responsibly. This score is derived from factors such as:

- Payment History: Consistently making payments on time for credit cards, loans, and other obligations is the most critical component. Late payments, defaults, and bankruptcies can severely damage your score.

- Credit Utilization Ratio: This is the amount of credit you’re using compared to your total available credit. Keeping this ratio low (ideally below 30%) signals that you’re not overextended.

- Length of Credit History: A longer history of responsible credit management generally contributes positively to your score.

- Credit Mix: Having a variety of credit types (e.g., credit cards, installment loans) can demonstrate your ability to manage different forms of debt.

- New Credit: Opening too many new credit accounts in a short period can negatively impact your score, as it can be perceived as a sign of financial distress.

Income Verification and Stability: The Ability to Repay

Beyond your credit score, lenders need to be convinced that you have a steady and sufficient income stream to meet your loan obligations. This involves providing documentation that verifies your employment status, salary, and any other sources of income.

- Employment History: Lenders will look for a consistent employment history, ideally with your current employer for a significant period. Frequent job changes can be a red flag, suggesting potential income instability.

- Proof of Income: This typically includes recent pay stubs, tax returns (for self-employed individuals or those with multiple income sources), and bank statements. The amount of income relative to the loan amount requested will be a key consideration.

- Debt-to-Income Ratio (DTI): This ratio compares your total monthly debt payments (including the proposed loan payment) to your gross monthly income. A lower DTI indicates that a smaller portion of your income is already committed to debt, leaving more capacity for the new loan. Lenders often have specific DTI thresholds they adhere to.

Existing Debt Obligations: The Financial Load

Lenders will also scrutinize your existing debt obligations. This includes mortgages, car loans, student loans, and outstanding credit card balances. They will assess how these existing payments, combined with the proposed new loan, will impact your ability to manage your finances. A high level of existing debt can make it challenging to secure new financing, as it may indicate a strained financial situation.

Presenting a Solid Loan Application

Once you understand what lenders are looking for, the next step is to assemble a compelling loan application that addresses these concerns proactively. This involves gathering necessary documentation, clearly articulating your need for the loan, and demonstrating your repayment plan. A well-prepared application not only speeds up the approval process but also significantly increases your chances of success.

Gathering Essential Documentation: The Paper Trail of Trust

Thorough documentation is crucial for a smooth loan application. Lenders require proof to validate the information you provide. Failing to supply complete and accurate documentation can lead to delays or outright rejection.

- Personal Identification: This typically includes a valid government-issued ID, such as a driver’s license or passport.

- Proof of Address: Utility bills, lease agreements, or mortgage statements can serve as proof of your residential address.

- Financial Statements: As mentioned previously, this includes recent pay stubs, bank statements, and tax returns. For business loans, balance sheets, income statements, and cash flow projections will be required.

- Information on Existing Debts: Details of your current loans, credit card balances, and monthly payments will be necessary.

- Purpose of the Loan Statement: Clearly outlining why you need the loan and how the funds will be utilized is vital. This is especially important for business loans or loans for specific purchases.

Collateral and Guarantees: Adding Security

Depending on the type and amount of loan, lenders may require collateral or a guarantor.

- Collateral: This is an asset you pledge to the lender as security for the loan. If you default on the loan, the lender can seize the collateral to recoup their losses. Examples include real estate, vehicles, or investments. The value of the collateral will be a key factor in the loan amount approved.

- Guarantor/Co-signer: A guarantor is an individual who agrees to be legally responsible for repaying the loan if the primary borrower defaults. A co-signer typically shares equal responsibility for the loan from the outset. Lenders often require a guarantor or co-signer if the primary applicant has a weaker credit profile or insufficient income.

Articulating the Loan Purpose: Clarity and Justification

Lenders want to understand precisely how their money will be used. A clear and justifiable purpose for the loan demonstrates that you have a well-thought-out plan and that the funds will contribute to a productive outcome.

- Specific Use of Funds: Be precise. Instead of saying “for business expansion,” state “to purchase new manufacturing equipment to increase production capacity by 20%.”

- Return on Investment (ROI): For business loans, demonstrating a strong potential ROI is critical. Show how the loan will generate revenue and contribute to the profitability of the business.

- Personal Benefit: For personal loans, clearly explain how the loan will improve your financial situation or quality of life. For example, consolidating high-interest debt can demonstrate a move towards better financial management.

Navigating the Loan Application Process

The loan application process itself can seem daunting, but understanding its stages and what to expect can alleviate anxiety and improve your preparedness. Each step is designed to gather information and assess your suitability as a borrower.

The Initial Application and Underwriting

The application process begins with submitting your loan request and all supporting documentation. This information is then handed over to the underwriting department, which is responsible for thoroughly evaluating your application.

- Information Verification: Underwriters will verify the accuracy of the information you’ve provided, cross-referencing it with credit bureaus, employers, and other sources.

- Risk Assessment: This is where the core analysis happens. Underwriters assess your creditworthiness, income stability, DTI, collateral (if any), and the overall risk associated with lending to you.

- Loan Terms and Conditions: Based on their assessment, underwriters will determine the loan amount, interest rate, repayment period, and any specific covenants or conditions.

Approval, Rejection, and Negotiation

The outcome of the underwriting process will result in one of three possibilities: approval, rejection, or a conditional approval that may require negotiation.

- Approval: Congratulations! Your loan has been approved, and you’ll receive a loan agreement detailing all the terms and conditions. Thoroughly review this document before signing.

- Rejection: If your loan is rejected, don’t despair. Request specific reasons for the denial, as this feedback is invaluable for future applications. It might indicate issues with your credit score, income, DTI, or insufficient collateral.

- Conditional Approval: This means the lender is willing to approve your loan, but with certain conditions that you must meet. This could involve providing additional documentation, increasing a down payment, or securing a co-signer. You may also have room to negotiate certain terms, such as the interest rate or repayment schedule, especially if you have a strong financial profile.

Post-Approval Steps: Finalizing the Deal

Once your loan is approved and you’ve agreed to the terms, there are a few final steps to finalize the deal and receive the funds.

- Loan Agreement Signing: This is the legally binding document. Ensure you understand every clause before signing.

- Disbursement of Funds: The loan amount will then be transferred to your designated account, either in a lump sum or in installments, depending on the loan type.

- Repayment Commencement: Be sure to understand when your first payment is due and set up a reliable payment method to avoid late fees and maintain a positive credit history.

Securing a loan requires preparation, transparency, and a clear understanding of the lender’s requirements. By focusing on building a strong financial foundation, presenting a meticulous application, and understanding the process, you can significantly enhance your prospects of obtaining the financing you need. Remember, a loan is a significant financial commitment, so approach it with diligence and a clear plan for repayment.