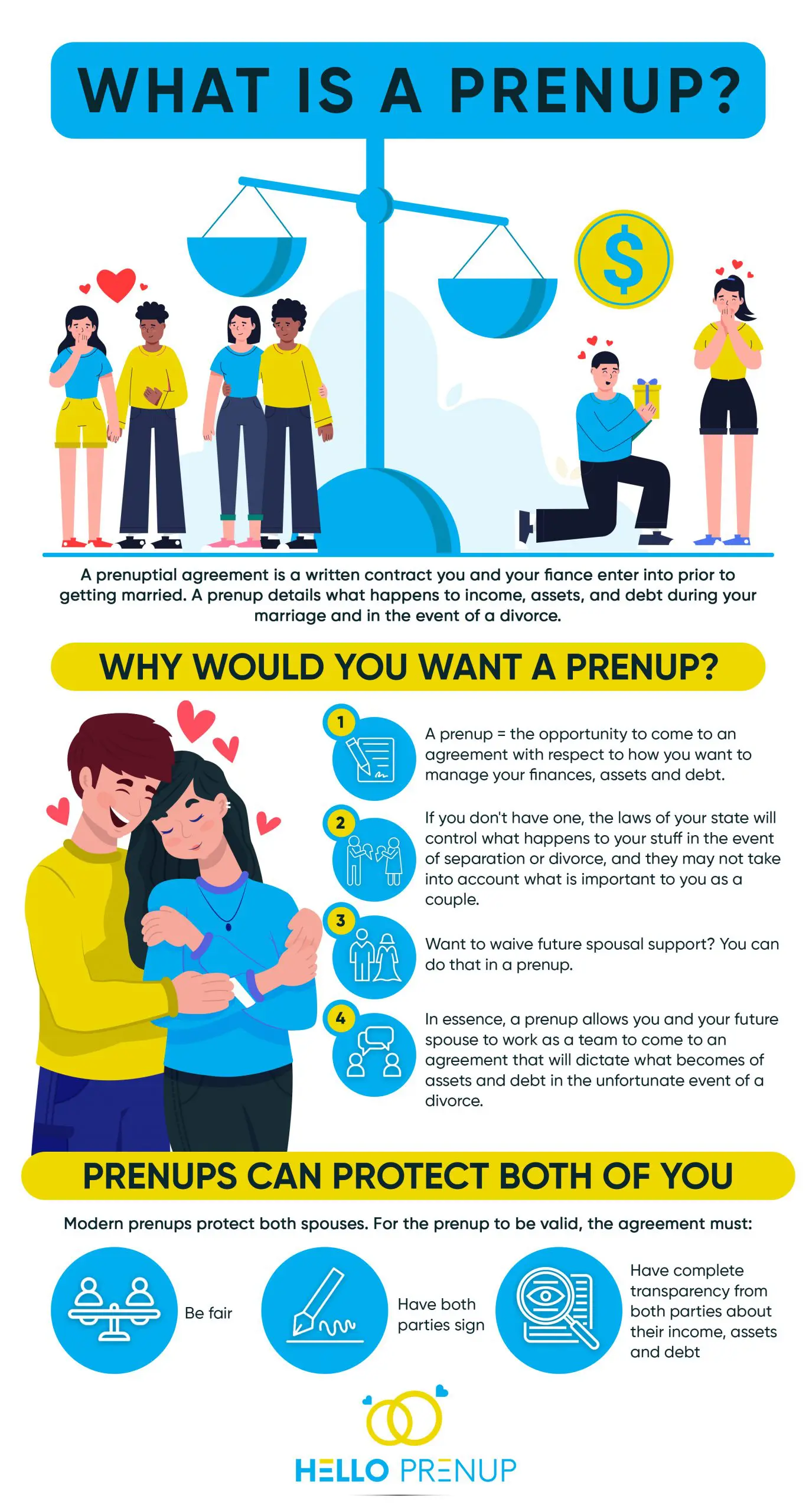

A prenuptial agreement, often referred to as a “prenup,” is a legally binding contract entered into by two individuals before they get married. Its primary purpose is to define how assets and debts will be divided in the event of divorce or death. While commonly associated with protecting wealth, a prenup’s scope extends far beyond just financial holdings, encompassing a wide array of protections for both parties involved. Understanding these protections is crucial for anyone considering entering into such an agreement.

Protection of Separate Property

One of the most fundamental aspects of a prenuptial agreement is the protection of separate property. This refers to assets that each individual owned before the marriage. Without a prenup, the laws of the state where the couple resides would dictate how these assets are treated in a divorce, which can often lead to them being considered marital property subject to division. A prenup explicitly outlines what constitutes separate property and ensures it remains with the original owner, regardless of the length of the marriage or any commingling of funds that might occur during it.

Defining and Segregating Pre-Marital Assets

The first step in protecting separate property is clearly defining it within the prenup. This involves creating a detailed inventory of all assets each party brings into the marriage. These assets can include real estate, bank accounts, investments, businesses, intellectual property, and even personal belongings of significant value. The agreement will then state that these identified assets, and any appreciation or income generated from them, will remain the sole property of the original owner.

This detailed listing is critical. Vague descriptions can lead to disputes later. For example, simply stating “all my stocks” might not be sufficient if the stock portfolio grows significantly or is reinvested. A more precise description, such as “shares in XYZ Corporation as of [date] and any dividends reinvested into that account,” provides greater clarity.

Shielding Inherited and Gifted Assets

Similarly, assets received through inheritance or gifts during the marriage can be designated as separate property through a prenup. Without this provision, these assets, if not kept strictly separate, could be viewed as marital property in some jurisdictions. The prenup ensures that any inheritances or gifts received by one spouse will remain theirs exclusively, preventing the other spouse from having a claim to them in a divorce. This is particularly important for family wealth that individuals may wish to keep within their lineage.

Safeguarding Business Interests

For individuals who own businesses or have significant stakes in them before marriage, a prenup is an invaluable tool. It can protect not only the business itself but also its future growth, profits, and any appreciation in value from being subject to division in a divorce. This is crucial for maintaining business continuity and preventing the other spouse from acquiring an unwanted ownership stake or demanding a payout that could cripple the business. The agreement can also address how any active involvement by the non-owner spouse during the marriage will be compensated or treated.

Addressing Marital Property and Debt Allocation

While prenups often focus on separate property, they are equally effective in defining how marital property (assets acquired during the marriage) and debts will be handled. This proactive approach can prevent protracted and acrimonious disputes over who gets what and who owes what when a marriage ends.

Clarifying the Definition of Marital Property

In the absence of a prenup, marital property laws vary by state. Some states follow community property principles, where all assets acquired during the marriage are owned equally by both spouses. Others follow equitable distribution, where assets are divided fairly, but not necessarily equally. A prenup allows couples to override these default rules and establish their own clear definitions of what constitutes marital property and how it will be divided. This can include specific allocations of certain assets or a predetermined percentage split.

Managing Joint and Individual Debts

Debts incurred before and during the marriage can also be addressed in a prenup. This includes mortgages, student loans, credit card debt, and business loans. The agreement can stipulate that individual debts remain the responsibility of the person who incurred them, even if acquired during the marriage. It can also outline how jointly acquired debts will be managed and divided. This clarity can prevent one spouse from being burdened with significant debt incurred by the other, especially if that debt was not for the direct benefit of the couple.

Spousal Support (Alimony) Provisions

Prenuptial agreements can also include provisions regarding spousal support, commonly known as alimony. Couples can agree to waive alimony entirely, limit the amount or duration of alimony, or set specific terms for its payment. It’s important to note that courts may scrutinize alimony waivers, especially if they leave one spouse in dire financial straits, but having a clearly defined agreement provides a strong starting point for negotiations.

Protecting Future Earnings and Inheritances

The protections offered by a prenup extend to future financial gains as well, providing a degree of certainty and control over one’s financial future.

Future Income and Investments

A prenup can specify that future income earned by either spouse, and any investments made with that income, will remain the separate property of the individual earning or investing it. This is particularly relevant for high-income earners or those expecting significant career advancements. It ensures that continued hard work and financial success do not automatically translate into shared ownership of future wealth.

Anticipated Inheritances and Gifts

Individuals who anticipate receiving significant inheritances or gifts from family members can use a prenup to ensure these future windfalls are protected as separate property. This is especially important if the family wishes for these assets to remain within a particular lineage or be used for specific purposes that may not align with the other spouse’s interests. The prenup provides a legal framework to uphold these intentions.

Ensuring Clarity and Reducing Future Conflict

Beyond the financial implications, prenuptial agreements serve a crucial role in fostering open communication and minimizing potential conflict during a divorce.

Promoting Open Communication About Finances

The process of creating a prenup often forces couples to have honest and sometimes difficult conversations about their finances, expectations, and concerns. This transparency can strengthen the relationship before marriage and equip the couple with a shared understanding of their financial landscape. It’s an opportunity to align on financial goals and values.

Streamlining Divorce Proceedings

In the unfortunate event of a divorce, a well-drafted prenup can significantly simplify the legal process. By pre-determining many of the key issues related to asset and debt division, as well as spousal support, couples can avoid lengthy and costly litigation. This can lead to a more amicable and less emotionally draining separation, allowing both parties to move forward more smoothly.

Protecting Children from Previous Relationships

For individuals with children from previous relationships, a prenup can be instrumental in ensuring that their assets are preserved for those children. It can stipulate that certain assets will be passed down to their children, regardless of divorce or remarriage. This provides peace of mind and ensures that the financial future of their existing family is secured.

In conclusion, a prenuptial agreement is a comprehensive legal tool that offers a wide range of protections. It safeguards separate property, clarifies the division of marital assets and debts, addresses spousal support, and protects future earnings and inheritances. More importantly, it fosters open communication and can significantly reduce conflict and streamline divorce proceedings. While often perceived as a sign of distrust, a prenup can, in fact, be a responsible and forward-thinking step towards establishing a secure and well-defined financial foundation for both individuals entering into marriage.