The process of buying or selling real estate is inherently complex, involving significant financial stakes, intricate legalities, and a multitude of parties. At the heart of many of these transactions lies a critical mechanism designed to safeguard the interests of both buyer and seller: escrow. Traditionally viewed as a purely financial and legal arrangement, the modern real estate escrow is increasingly being reshaped by technological advancements, transforming how these crucial intermediaries operate and adding layers of innovation to the entire process. Understanding escrow, through a lens of technological innovation, reveals a sophisticated system designed for security, efficiency, and trust in one of life’s most significant investments.

The Technological Foundation of Modern Escrow

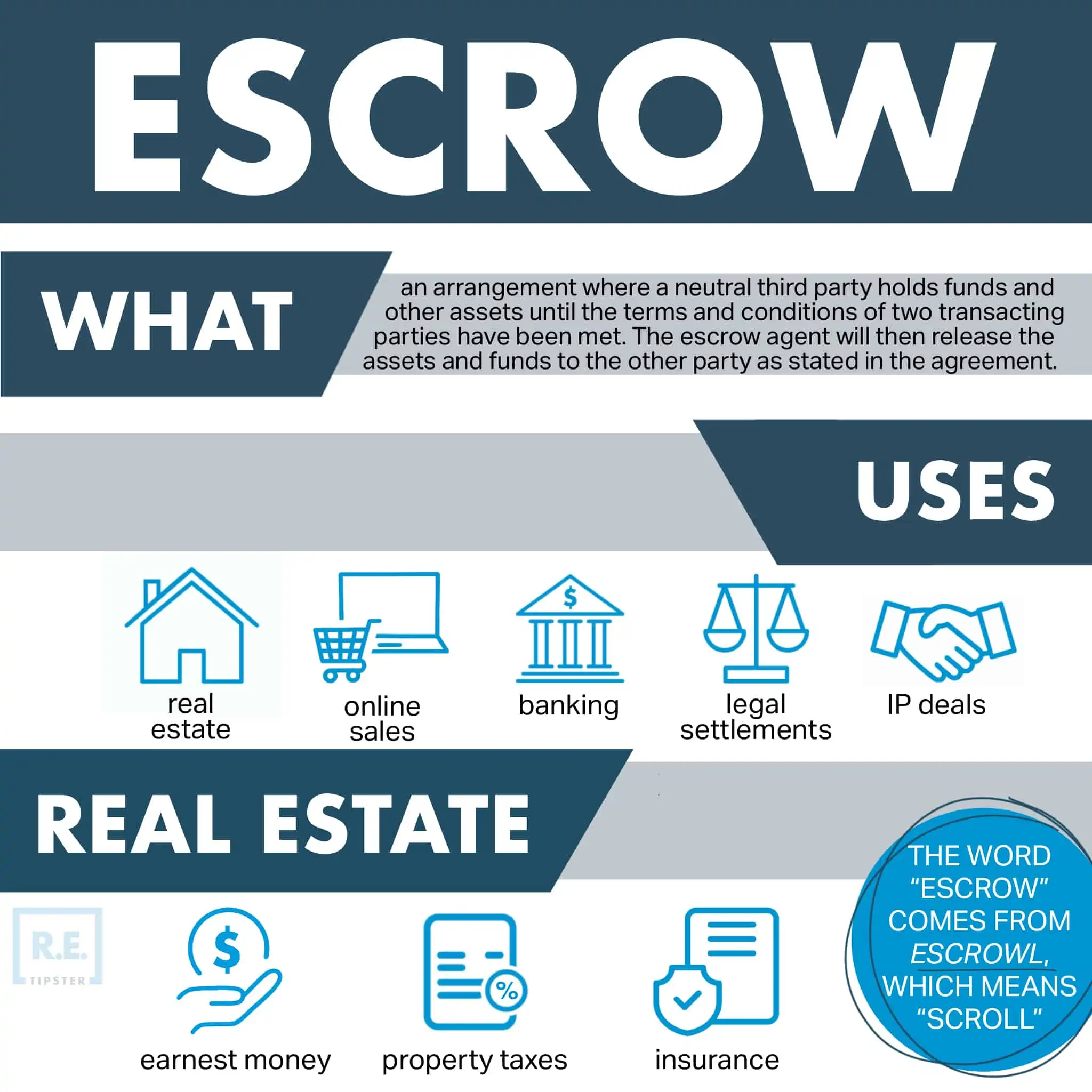

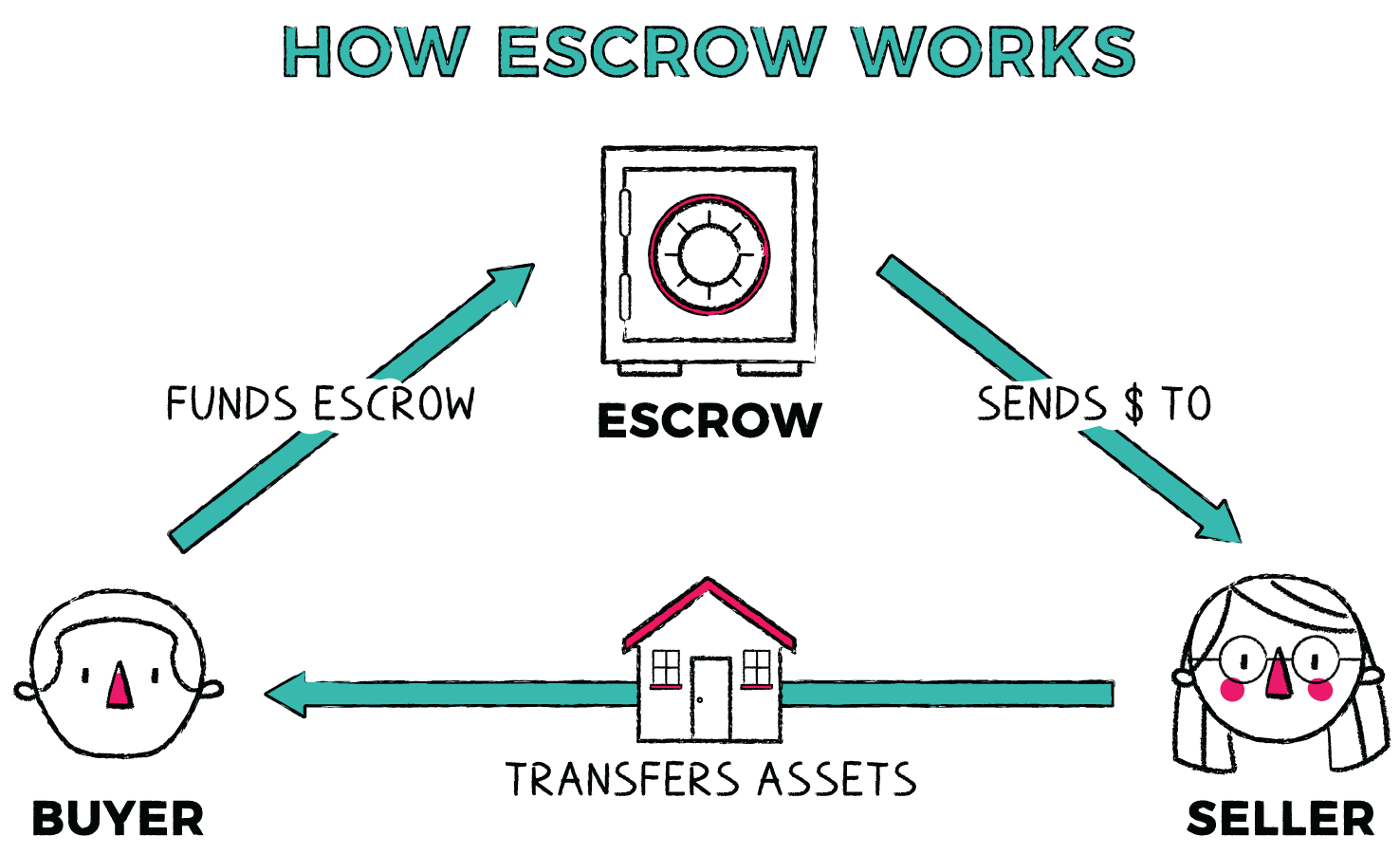

In its essence, escrow acts as a neutral third party that holds funds and documents related to a real estate transaction until all agreed-upon conditions are met. However, the infrastructure supporting this vital function has evolved dramatically, leveraging technology to enhance security, streamline communication, and ensure accuracy. This technological foundation is not merely an add-on; it’s becoming the bedrock upon which efficient and secure escrow services are built.

Secure Digital Asset Management

One of the most significant technological contributions to escrow is the advent of secure digital asset management. In the past, escrow involved mountains of physical paperwork and the physical handling of checks and money orders. Today, sophisticated encryption and secure cloud-based platforms are employed to manage sensitive documents and financial information.

Blockchain and Distributed Ledger Technology (DLT)

While not yet universally adopted, the exploration and implementation of blockchain and Distributed Ledger Technology (DLT) are emerging as significant innovations in escrow. Blockchain offers a decentralized, immutable ledger that can record every transaction and document change. This inherent transparency and tamper-proof nature can drastically enhance security and reduce the risk of fraud. For escrow, this could translate into a verifiable audit trail for all funds and documents, providing unparalleled assurance to all parties involved. Imagine a future where every step of the escrow process is recorded on a blockchain, visible to authorized participants, and unalterable once confirmed. This level of security and accountability is a testament to the innovative potential of DLT in financial transactions.

Encrypted Data Storage and Transfer

Beyond the more futuristic applications of blockchain, current escrow services rely heavily on robust encryption protocols for data storage and transfer. Sensitive buyer and seller information, financial details, and legally binding documents are stored in secure, encrypted databases. When documents need to be shared between parties – the buyer, seller, lender, title company, and the escrow agent – secure, encrypted portals and transfer methods are utilized. This minimizes the risk of data breaches and ensures that confidential information remains protected throughout the transaction lifecycle. Innovation in cybersecurity is directly impacting the safety and reliability of escrow services.

Digital Platforms and Workflow Automation

The operational side of escrow has been revolutionized by digital platforms and the automation of workflows. These technologies are not just about digitizing paper; they are about fundamentally rethinking and optimizing the escrow process to be faster, more efficient, and less prone to human error.

Integrated Transaction Management Systems

Modern escrow companies often utilize integrated transaction management systems (TMS) that serve as a central hub for all aspects of the deal. These platforms can facilitate the secure exchange of documents, track deadlines and contingencies, manage communication between parties, and even integrate with other real estate technology systems like digital signature platforms and appraisal software. This holistic approach ensures that all stakeholders have real-time access to the most current information, reducing delays and misunderstandings. The innovation here lies in creating a cohesive digital ecosystem for the entire transaction.

Automated Contingency Tracking and Alerts

A crucial part of any real estate transaction is managing contingencies – conditions that must be met for the deal to proceed (e.g., financing approval, home inspection results). Escrow platforms employ sophisticated automation to track these contingencies, monitor their fulfillment, and trigger automated alerts to relevant parties as deadlines approach. This proactive approach prevents missed deadlines, which can derail a transaction, and keeps everyone informed and on track. The innovation is in moving from manual tracking to intelligent, automated oversight.

Digital Signatures and Remote Online Notarization (RON)

The advent of digital signatures and Remote Online Notarization (RON) has been a game-changer for escrow, particularly in reducing the need for physical presence. Buyers and sellers can now sign critical documents electronically from anywhere in the world, with the assurance that these signatures are legally binding and secure. RON allows notaries to perform their duties remotely using audio-visual technology, further streamlining the closing process. This innovation significantly enhances convenience and accessibility, making it easier for parties to complete their obligations within the escrow framework.

The Evolution of Escrow Agents: Bridging Technology and Expertise

The role of the escrow agent is also evolving in parallel with technological advancements. While their core fiduciary duty remains the same, the tools and methods they employ are increasingly sophisticated, requiring a new blend of technical proficiency and traditional expertise.

Data Analytics and Risk Mitigation

The vast amount of data generated during a real estate transaction, when processed through advanced analytics, can offer significant insights for risk mitigation within the escrow process. Tech-savvy escrow agents can leverage this data to identify potential red flags, such as unusual transaction patterns or discrepancies in documentation, before they become significant problems.

Predictive Analytics for Fraud Detection

Emerging technologies in fraud detection are being integrated into escrow platforms. By analyzing historical data and identifying anomalous patterns, predictive analytics can help flag potentially fraudulent activities, such as forged documents or suspicious fund transfers. This proactive approach to risk management is a critical innovation that enhances the security and integrity of the escrow process. The goal is to move from reactive problem-solving to proactive risk avoidance.

Performance Monitoring and Process Optimization

Technology allows escrow agents to monitor the performance of their processes in real-time. Key performance indicators (KPIs) related to transaction speed, error rates, and client satisfaction can be tracked, enabling continuous improvement and optimization of workflows. This data-driven approach to operational management is a hallmark of innovation, ensuring that escrow services remain efficient and effective in a rapidly changing market.

Enhanced Communication and Collaboration Tools

Effective communication is paramount in real estate transactions. Technological innovations have provided escrow agents with more powerful and streamlined tools to facilitate collaboration among all parties involved.

Secure Messaging and Collaboration Portals

Beyond standard email, escrow platforms often offer secure messaging features and dedicated collaboration portals. These tools allow all authorized participants to communicate directly within the platform, keeping all relevant discussions and decisions consolidated and easily accessible. This eliminates the confusion of scattered email threads and ensures that important information is not lost. The innovation lies in creating a controlled and transparent communication environment.

Virtual Meetings and Consultations

The ability to conduct virtual meetings and consultations via video conferencing has become invaluable, especially for remote buyers or sellers, or when all parties cannot easily gather in one place. Escrow agents can use these tools for client onboarding, explaining complex documents, and addressing concerns, all while maintaining a personal connection through technology. This adds a layer of personalized service facilitated by technological means.

Future Frontiers: AI and the Next Generation of Escrow Innovation

The influence of artificial intelligence (AI) and machine learning (ML) is poised to further redefine the escrow landscape, ushering in an era of even greater automation, predictive capabilities, and personalized service.

AI-Powered Document Analysis and Verification

AI algorithms are becoming increasingly adept at analyzing and verifying complex legal and financial documents. In the context of escrow, this could mean AI systems that can quickly scan loan applications, purchase agreements, and title reports for accuracy, completeness, and potential discrepancies, flagging issues for human review much faster than manual processes.

Natural Language Processing (NLP) for Contract Review

Natural Language Processing (NLP) allows AI to understand and interpret human language. This technology can be applied to review contracts, identifying key clauses, obligations, and potential risks that might be overlooked by human reviewers. This capability can significantly expedite the due diligence phase of the escrow process.

Automated Compliance Checks

Ensuring compliance with a myriad of regulations is a significant burden in real estate transactions. AI can automate these compliance checks, comparing transaction details against relevant laws and guidelines, and flagging any potential non-compliance. This reduces the risk of costly legal issues and delays.

Autonomous Transaction Management and Intelligent Agents

The ultimate vision of technological innovation in escrow might be the development of increasingly autonomous transaction management systems, potentially guided by intelligent agents.

Smart Contracts and Automated Fund Disbursements

The concept of smart contracts, self-executing contracts with the terms of the agreement directly written into code, holds immense promise for escrow. Once conditions are met (verified by secure data inputs), a smart contract could automatically trigger the disbursement of funds, eliminating the need for manual intervention and significantly speeding up the closing process.

AI Assistants for Client Support

AI-powered chatbots and virtual assistants can provide instant support and answer frequently asked questions for buyers and sellers interacting with the escrow process. These intelligent agents can guide users through platforms, explain terminology, and provide status updates, freeing up human escrow officers to handle more complex issues and personalized client needs.

In conclusion, while the fundamental purpose of escrow remains steadfast – to ensure a secure and equitable real estate transaction – its operational reality is being dramatically reshaped by technological innovation. From the secure digital management of assets and automated workflows to the burgeoning influence of AI and DLT, the escrow process is becoming more efficient, transparent, and secure. Understanding these technological underpinnings is crucial for anyone involved in real estate, as they represent the future of safeguarding one of the most significant financial undertakings in our lives. The ongoing integration of technology isn’t just a convenience; it’s a fundamental advancement in how trust and security are built in the digital age of real estate.